In response to the Federal Communications Commission’s request for input on the state of the competition in the communications marketplace, EchoStar has shared its views.

EchoStar believes that the current market is a three-player market, dominated by AT&T, T-Mobile, and Verizon, and this dynamic is hurting customers. It didn’t forget to mention that just recently, T-Mobile raised prices for legacy plan holders, and how this announcement coincided with the admission that the company’s “business and the cash flow generation continues on.”

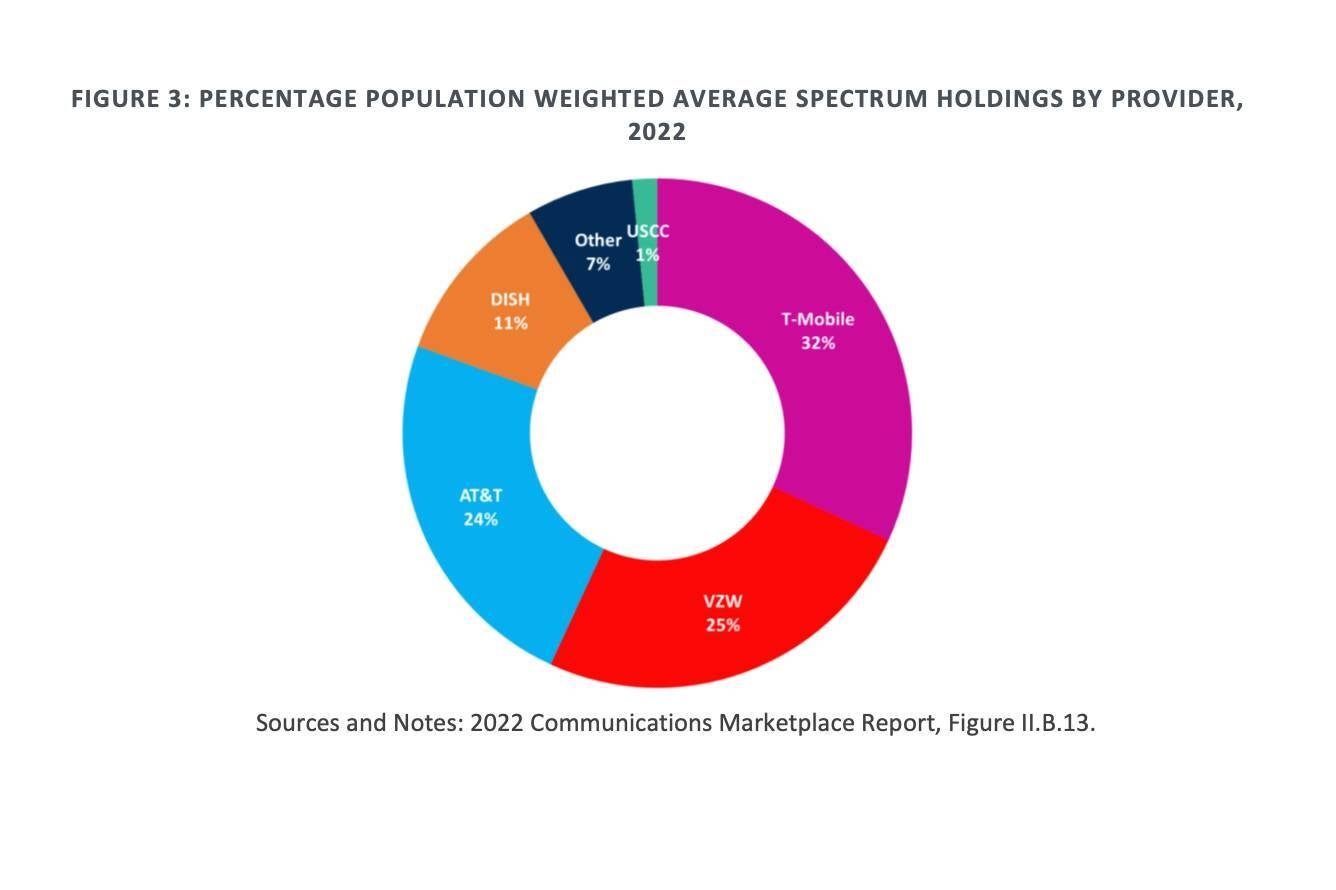

The company, which prides itself on being the first to build a standalone 5G Open RAN cloud-based network that covers 73 percent of the US population, is having a hard time competing with the more established players. That’s because, according to EchoStar, AT&T, TMobile, and Verizon hold the vast majority of the country’s available spectrum, which helps them gain even more market share and stifle competition.

The FCC and Department of Justice or DOJ wanted to position DISH as a Sprint replacement after the latter’s merger with T-Mobile but the plan has clearly not been working out well. DISH backed out of its plans to buy low-band spectrum from T-Mobile in March due to a lack of funding. T-Mobile was required to sell 14 megahertz of spectrum in the 800 MHz band for $3.6 billion to gain approval for the Sprint acquisition.

DISH is having second thoughts though and is now complaining that the carrier is making it difficult for it to participate in the auction. The company has been requesting T-Mobile for relevant rules and procedures for the auction since April 9 as it evaluates its participation.

EchoStar has even hinted that T-Mobile may have changed its mind about selling the 800 MHz licences and is hoping the auction will fail as it believes it can put the spectrum to good use.

Spectrum accumulation harms competitors, says EchoStar

EchoStar has targeted T-Mobile more than the other two carriers in its report. It says T-Mobile has its eyes on valuable low-band spectrum and has been on an acquisition spree to achieve its goals. It recently bought Mint and Ultra Mobile and now wants to buy most of U.S. Cellular.

T-Mobile has also announced a string of “a series of spectrum acquisitions in the critically important 600 MHz band, including from Columbia Capital, Horry Telephone Cooperative, and Comcast.” EchoStar says that T-Mobile engineered the transaction in a way that would avoid serious scrutiny by the FCC. EchoStar alleges that T-Mobile wants to dominate the 600 MHz band “to the detriment of competition and consumers.”

T-Mobile has failed to give a compelling reason as to why it needs even more low-band spectrum even after merging with Sprint. When expressing its intention to buy 600 MHz spectrum from Comcast, the company stated that it wanted to do that “not out of a capacity concern or an immediate need,” but because 600 MHz “is a great spectrum band.”

EchoStar fears that the company’s only motive is to prevent competitors from using the band. After all, spectrum is limited in supply.

T-Mobile has itself not shied away from telling investors that the reason why it has been doing so well is that it has “lots of 5G spectrum, that’s how you win.”

EchoStar also believes that T-Mobile‘s purchase of Mint and Ultra will incentivise it to discriminate against the remaining MVNOs and if its purchase of U.S. Cellular is allowed to go through, it would harm the wireless market further.

EchoStar has urged the FCC to update the spectrum screen and has proposed a 25 percent national spectrum cap and a 25 percent screen for low-band spectrum.

This step, according to the company, could help move the country closer to its goal of having at least four nationwide carriers.

👇Follow more 👇

👉 bdphone.com

👉 ultraactivation.com

👉 trainingreferral.com

👉 shaplafood.com

👉 bangladeshi.help

👉 www.forexdhaka.com

👉 uncommunication.com

👉 ultra-sim.com

👉 forexdhaka.com

👉 ultrafxfund.com