Recent satellite deployments have significantly enhanced Starlink’s performance in Europe, reinforcing its status as a viable broadband alternative in the region.

While Europe may not be the largest market for satellite-based internet – especially compared to regions with lower fibre penetration and more dispersed populations – low Earth orbit (LEO) networks are proving to be an essential component of the connectivity landscape.

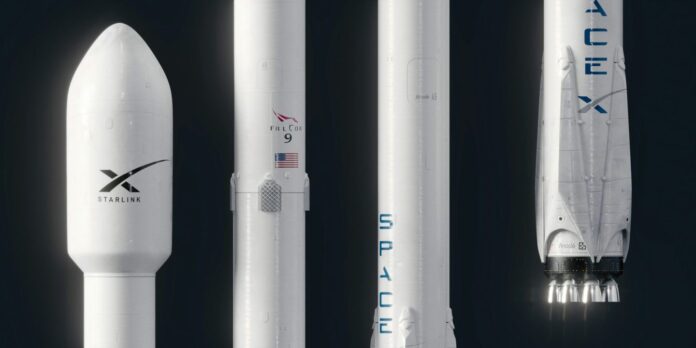

SpaceX’s Starlink remains at the forefront of this LEO revolution, not just in Europe but globally. With a constellation exceeding 7,000 satellites, it offers broad coverage and high capacity, making satellite broadband more accessible.

As demand for high-speed, low-latency internet grows, even in unexpected urban locations like London, where Starlink has reached full capacity and sold out, SpaceX has acted swiftly. The company has increased ground station density and accelerated its schedule of satellite launches in the latter half of 2024, with the goal of enhancing coverage and network performance.

With fibre-to-the-home (FTTH) infrastructure expanding rapidly across Europe, can Starlink maintain its competitive edge? The following examines how SpaceX’s latest investments are improving speeds, reducing latency, and positioning Starlink in Europe’s evolving broadband market.

Latency improvements: Starlink in Europe

One of the biggest historical drawbacks of satellite internet has been latency – the time it takes for data to travel to and from a user. Unlike traditional broadband, which operates through underground cables, satellites relay signals between space and the Earth’s surface, making latency a major challenge.

Starlink’s LEO constellation, however, has drastically reduced these delays. Over the past two years, median latency across Europe has dropped significantly, closing the gap with terrestrial broadband. In Q4 2024, some of the lowest median latencies on the continent were recorded in:

- United Kingdom – 41 ms

- Belgium – 46 ms

- Luxembourg – 46 ms

- Ireland – 47 ms

The reductions have had a direct impact on user experience, particularly for video streaming, gaming, and web browsing, where lower latency translates to faster load times and more responsive interactions.

SpaceX’s European network has been expanded to improve these specific outcomes. Starlink has been able to minimise signal travel distances by strengthening inter-satellite links, increasing ground station density, and optimising data routing.

While latency for fixed broadband still remains lower overall, Starlink is closing the gap at a faster rate than improvements seen in terrestrial networks. A few regions, however, continue to face issues. Cyprus (144 ms) and Malta (106 ms) recorded the highest latencies, most likely due to a lack of nearby ground stations, a situation which necessitates an increased reliance on inter-satellite relays.

Download speeds: growing network demand

While latency has shown consistent improvement, Starlink’s download speeds have faced fluctuations as its user base grows. Between Q4 2022 and Q4 2023, speeds declined in Central Europe due to increased network demand. Countries like Germany (down 31%) and Switzerland (down 24%) experienced sharp drops in median download speeds.

However, Q4 2024 brought a reversal of this trend, with significant speed improvements observed, including increases reported in:

- Croatia – ~70% increase

- Greece – ~65% increase

- Germany – 18% increase

- Switzerland – 11% increase

The improvements coincided with SpaceX’s aggressive expansion, including a increase in the number of active Starlink satellites in late 2024. The additional capacity appears to have helped to stabilise network performance, especially in Southern Europe, where Starlink is emerging as a top-performing broadband option.

Despite its improvements, Starlink’s download speed advantage is losing in many markets where fibre broadband expansion is accelerating. In Q4 2024, LEO broadband still outperformed terrestrial broadband in some regions, including Greece, Croatia, Italy, Austria, the Czech Republic, and Estonia – countries that lag behind the EU average in FTTH coverage.

However, as fibre adoption continues to rise across Europe, maintaining a competitive speed edge will be increasingly difficult for Starlink.

Where Starlink holds strong: Rural markets and fibre gaps

Starlink’s adoption in Europe varies widely by region, largely depending on the availability of high-speed fixed broadband options. In highly urbanised markets, like the Nordics and Benelux, Starlink adoption remains low due to widespread fibre availability and strong fixed wireless access (FWA) alternatives.

Conversely, in Central and Southern Europe, where fibre deployment lags behind the EU average, Starlink has gained a stronger foothold. Countries like Germany, Greece, and Croatia have higher adoption rates, as Starlink often outperforms local broadband options in speed or availability.

Germany, in particular, is an interesting case. Despite being one of Europe’s leading economies, it has little fibre coverage and some of the highest broadband prices in the EU. As a result, Starlink has emerged as an appealing alternative, despite the fact that its speeds in the country are lower than those available in other regions.

Beyond residential use, Starlink is also gaining traction in specialised applications. In London, for example, it is heavily used for business connectivity, like powering card payment terminals and temporary networks.

The next phase: Starlink’s push into direct-to-device (D2D) services

SpaceX’s ambitions for Starlink in Europe go beyond home broadband. The company is now focusing on the direct-to-device (D2D) sector, in which smartphones connect to satellites without the need for additional hardware.

The trend is being driven by new Gen2 satellites, which SpaceX intends to deploy at scale over the next few years. If successful, the company might shake up the mobile industry by providing connectivity in locations where cellular networks are unreliable or nonexistent.

However, competition in the LEO space race is heating up. Amazon’s Project Kuiper plans to deploy over 1,000 satellites by mid-2026, while AST SpaceMobile is focusing on D2D connectivity, with the goal of expanding its constellation to more than 240 satellites.

How Starlink adapts to this increasing competition will determine whether it remains a dominant force in satellite broadband.

(Photo by Unsplash)

See also: UK Space Agency awards £16M to satellite projects

Looking to revamp your digital transformation strategy? Learn more about Digital Transformation Week taking place in Amsterdam, California, and London. The comprehensive event is co-located with IoT Tech Expo, AI & Big Data Expo, Cyber Security & Cloud Expo, and other leading events.

Explore other upcoming enterprise technology events and webinars powered by TechForge here.

👇Follow more 👇

👉 bdphone.com

👉 ultractivation.com

👉 trainingreferral.com

👉 shaplafood.com

👉 bangladeshi.help

👉 www.forexdhaka.com

👉 uncommunication.com

👉 ultra-sim.com

👉 forexdhaka.com

👉 ultrafxfund.com

👉 bdphoneonline.com

👉 dailyadvice.us